A focus on US equities

As a second Trump term nears, investors and policymakers are preparing for its economic impact. While Trump's first term offers valuable insights on what we can expect, current issues like inflation and geopolitical tensions add complexity. We have prepared an extensive overview of potential economic shifts, financial opportunities and key policies under Trump’s second term in office.

Marketing Communication

DPAM B Equities US Dividend Sustainable - B

DPAM L Equities US

Sustainable - B

Implications and takeaways of a second Trump Presidency

Our expert Bruno Lamoral shares a concise overview of possible market developments following Trump's election victory

Related articles

Driving growth with dollars and dividends

The United States stands as the world's largest equity market, making it a critical component in any ...

Quality, sustainability and US equity

For those prioritising strong returns, the US continues to deliver a compelling case. Its economy promotes ...

The aftermath of the US elections

There are decades where nothing happens and weeks where decades happen. This quote by Lenin seems appropriate for what happened last week ...

Four more years of Trump: what does it mean for the markets?

As a second Trump term approaches, financial markets, investors, and policymakers are closely analysing its impact on ...

The US fight over ethical finance

The anti-ESG movement in the U.S. has gained significant momentum, particularly during the 2023 and 2024 proxy seasons. According to recent reports ...

Why is the US pushing back on ESG?

In recent years, the US has witnessed a growing criticism against Environmental, Social, and Governance (ESG) investing. This shift has been characterised by ...

Do not wait for the US election outcome

The US presidential election is a highly publicised event, taking place every four years at the beginning of November. The Election Day is fixed as the ...

Trump versus Harris - who moves the markets?

Curious about how the showdown between Kamala Harris and Donald Trump will affect your investments? Our portfolio manager Bruno Lamoral analyses the potential ...

The global ripples of Trump’s second term

The potential policy shifts under a Donald Trump presidency have sparked considerable debate in recent months, especially concerning ...

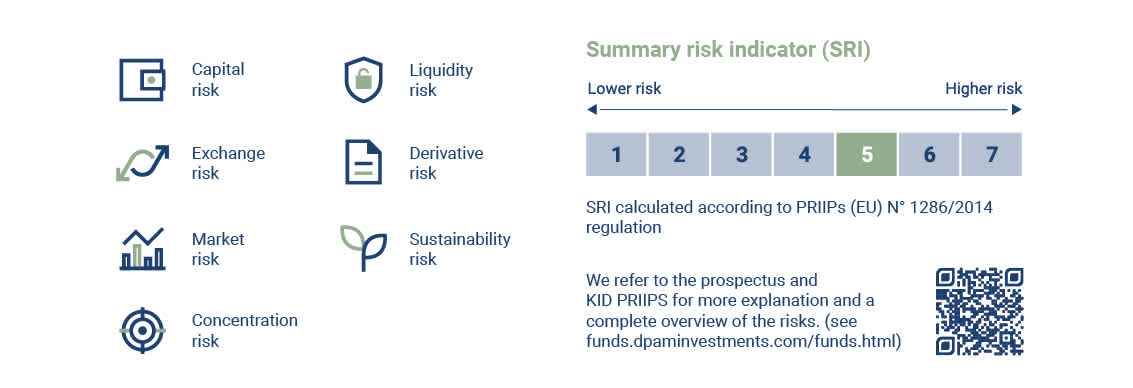

Risks

We closely monitor portfolios to further contain the risks that could impact the value of your investment. Even so, investing in equity solutions comes with inherent risks. As there is no capital protection or guarantee, you can lose part or all of your capital. The risks that can have a high to moderate impact on the investments are listed below.

ESG challenges contain both risks and opportunities. Through thorough analysis, our experts weigh the benefits against the risks to make informed investment decisions.

DPAM B Equities US Dividend Sustainable - B

DPAM L Equities US Sustainable - B

Disclaimer

Degroof Petercam Asset Management SA/NV (DPAM) l rue Guimard 18, 1040 Brussels, Belgium l RPM/RPR Brussels l TVA BE 0886 223 276 l

For professional investors only.

This is marketing communication. Please refer to the prospectus and the KID of the fund before making any final investment decisions. These documents can be obtained free of charge at DPAM or on the website https://funds.dpaminvestments.com. Investors can find a summary of their investor rights (in English) on https://www.dpaminvestments.com/professional-end-investor/be/en/regulatory-disclosures.

The management company may decide to terminate the arrangements made for the marketing of this collective investment undertaking in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU.

The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus or in the information which is to be disclosed to investors in accordance with Article 23 of Directive 2011/61/EU, Article 13 of Regulation (EU) No 345/2013, Article 14 of Regulation (EU) No 346/2013 where applicable.

All rights remain with DPAM, who is the author of the present document. Unauthorized storage, use or distribution is prohibited. Although this document and its content were prepared with due care and are based on sources and/or third party data providers which DPAM deems reliable, they are provided without any warranty of any kind and without guarantee of correctness, completeness, reliability, timeliness, availability, merchantability, or fitness for a particular purpose. All opinions and estimates are a reflection of the situation at issuance and may change without notice. Changed market circumstance may invalidate statements in this document.

The provided information herein must be considered as having a general nature and does not, under any circumstances, intend to be tailored to your personal situation. Its content does not represent investment advice, nor does it constitute an offer, solicitation, recommendation or invitation to buy, sell, subscribe to or execute any other transaction with financial instruments.

This document is not aimed to investors from a jurisdiction where such an offer, solicitation, recommendation or invitation would be illegal. Neither does this document constitute independent or objective investment research or financial analysis or other form of general recommendation on transaction in financial instruments as referred to under Article 2, 2°, 5 of the law of 25 October 2016 relating to the access to the provision of investment services and the status and supervision of portfolio management companies and investment advisors.