Fixed income

Rate revelations for 2024: A deep dive

Back to all

From hawkish heights to dovish depths, our government bond experts perform a detailed analysis of 2023’s main market-movers and reveal what fixed income investors can expect going forward.

During 2023, the global economy held up much better than most had expected at the start of the year. We experienced one of the steepest and strongest tightening cycles by central banks, but it takes time for monetary policy tightening to be fully transmitted to the real economy. However, since a few months ago, we have started to see that this is actually the case. Both the interest rate hikes and the normalisation of central bank balance sheets are being forcefully transmitted to the real economy.

This especially holds true for Europe, but also for the United States. In the latter, it is taking more time for monetary policy to work through the real economy as fiscal policy was too lenient for too long. What has been very interesting this year is that market reactions to new incoming data were erratic, yet predictable. We can call this ‘predictable erraticness’, and the next examples will show you what we mean by this. It ultimately leads to volatility in interest rates.

In September 2023, markets discovered a new mantra. No longer FOMO, TINA, or any other acronym, but something much simpler called ‘higher for longer’. The relative resilience of the American economy, in particular, versus the strength of the tightening cycle surprised many. This dichotomy led many to believe that the economy had become more immune to monetary policy cycles. Consequently, the conviction was that interest rates would stay high, for longer. But what many forgot was that it takes time before monetary policy is fully reflected in the real economy as economic agents need time to adjust their decisions and actions. In the United States, it was the relentless fiscal expansion of the government that created continued consumer demand and counteracted any monetary policy tightening. Also—importantly—the largest part of the fiscal policy measures was current spending and, as such, did not alter the fundamentals of the American economy.

However, central banks are seeing clear effects of their tightening cycle. At the Fed’s monetary policy meeting in December, they changed tone and gave a more dovish signal. Although they agree that the resilience of the US economy remains intact, their focus has shifted to the risk of undershooting the inflation target. For investors, this was a clear sign that the Fed would gradually start cutting the policy rate to reignite US growth. Predictably, this led to an aggressive upward repricing of risk assets and a rally in government bonds. This is typical behaviour in the months leading up to a cutting cycle and pushes risk markets to new highs. This is also very erratic, as the shift in mindset from ‘higher for longer’ to ‘interest rates will drop’ happens very fast. However, we expect this will change over the coming months.

What investors have done is redefining what a soft landing is, as this was the prerequisite for the risk rally. Up until a few months ago, a soft landing was defined as small, but still positive real GDP growth. More recently, a soft landing has been redefined to negative real GDP growth, but only to a small extent. Historically, this is what has always happened and, consequently, predictably we can assume what happens next.

In the near future, both investors and economists should realise that the economy has moved to the next phase in the cycle and a hard landing will become their base case. In that scenario, even if certain markets price in numerous cuts by the Fed and the ECB, these central banks will deliver and cut rates more aggressively than what is currently priced in. And markets will then again, in an erratic but predictable way, overshoot what central banks are doing.

Instead of the ‘higher for longer’ mantra, they will be moving towards the ‘lower for longer’ mantra that was present before the Covid crisis. Reality will always be something in between, but this relative predictableness of market reactions can be used to position yourself.

Over the remainder of this note, we will delve deeper into the macro-economic situation in Europe and in the United States.

We believe that Europe is already in a recession.

Since the second quarter of 2023, we have started observing certain red flags in economic data across Europe. From a positive perspective, China exited its Covid lockdowns, energy prices dropped to almost pre-war levels, and overall inflation also began to decrease. However, a specific part of the European economy failed to rebound. The manufacturing sector continued to deteriorate although all the stars were aligned for it to boom. This weakness in manufacturing was mainly driven by weak domestic demand following the high inflation environment. It even continued to deteriorate going into the second quarter of the year. Up until then, international demand for European goods was still positive, but over the summer, this too started to drop.

It is perfectly possible for the European economy to experience a manufacturing trough as long as the services sector compensates for it. This was the case, but August brought a new red flag. Typically, during summer, tourism is at its peak, resulting in a strong services sector. But in August, even the services sector fell into contraction territory, as indicated by PMI data.

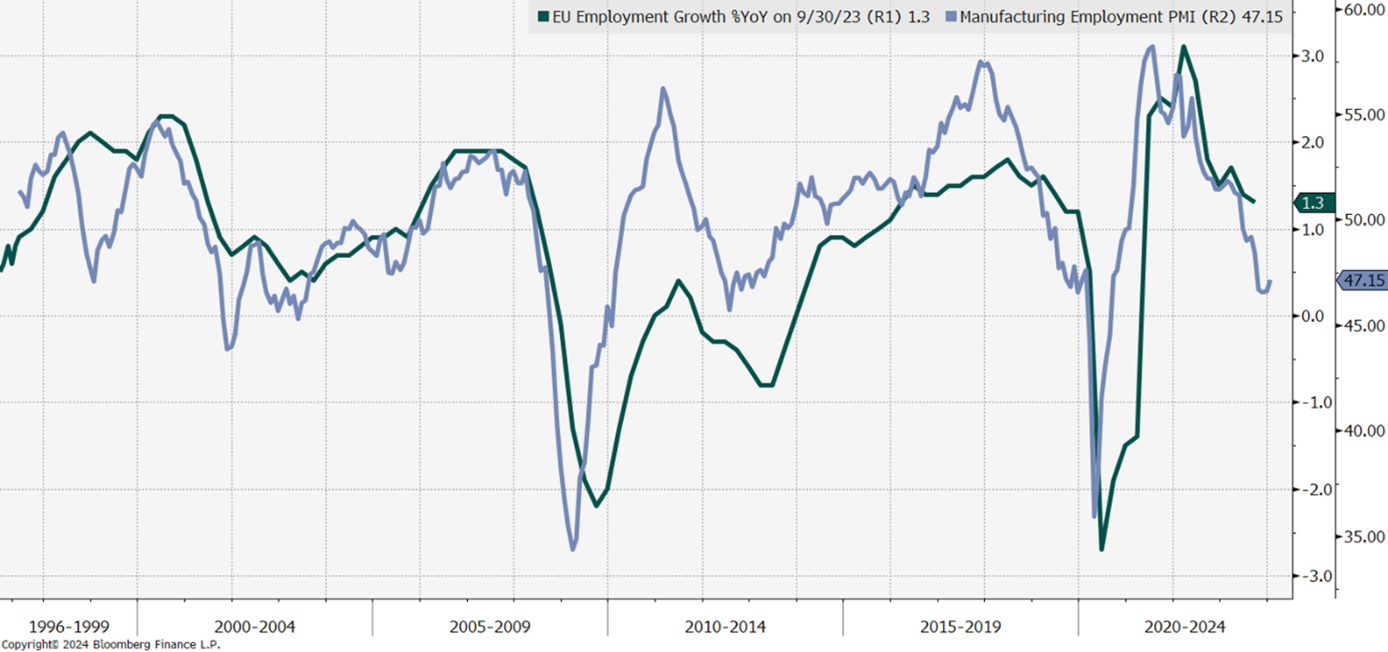

It is crucial to closely monitor incoming data during this time, as a period of weak activity often leads to a softening labour market. This presents the biggest risk to the European economy. When real economic activity consistently decreases, the demand for labour will also decrease, starting a vicious cycle of decreasing activity and increasing unemployment. The forward-looking relationship between ‘soft’ labour law and ‘hard’ labour data is given on the graph below. Not only has soft data consistently deteriorated over the last few quarters, but hard economic data also shows a clear and broad-based deterioration. Bankruptcy data, inflation-adjusted retail sales, European import and export data, labour market revisions, etc., all point towards the possibility that this vicious cycle has already started, and Europe is already in a recession. When reviewing a longer timeframe, the only instances these data were on this type of downward trend was when we were already in a recession. While it is possible that this time may be different, history suggests otherwise.

Employment PMIs are pointing towards a labour market that is quickly shifting

source: Bloomberg, PMI by S&P Global, Eurostat, February 2024

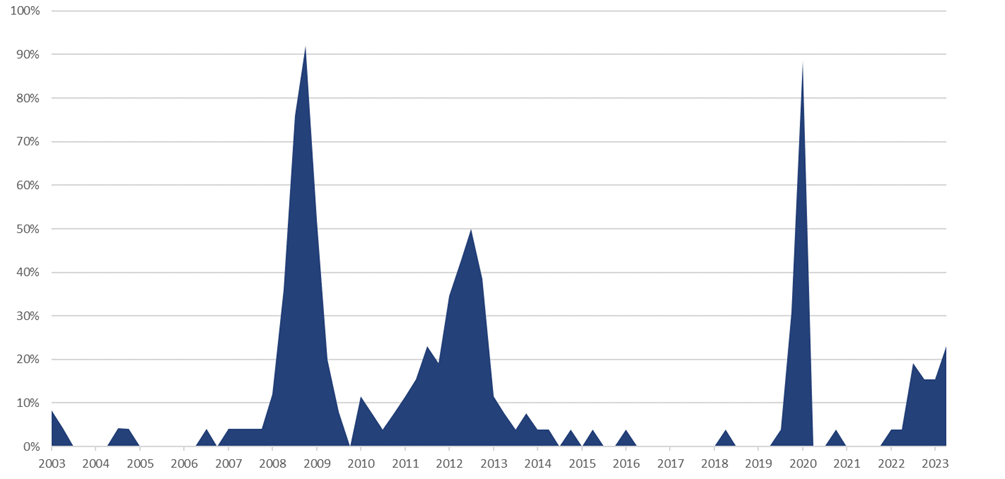

To determine if Europe is in a recession, we can simply look at its definition. A recession constitutes two successive quarters of negative real GDP growth. Based on this definition, over 25% of European Union countries are in recession. Furthermore, more than half of European countries experienced negative real GDP growth in the third quarter of the year. This does not necessarily mean that they will fall into a recession, but it is difficult to see a change in momentum given that underlying activity data has continued to deteriorate. There are not many solutions available to change this scenario. One of them requires the ECB to start actively cutting interest rates. Unfortunately, it is clear that the ECB is not ready for this and is risking a severe policy mistake.

% of EU countries in a recession during Q2 and Q3 2023

Source: Eurostat, February 2024

In the United States, the situation is somewhat different, but the economic landscape is also changing, and we are starting to see some signs of weakness on the horizon.

The year began abruptly with the collapse of the regional bank SVB, leading to a flight to quality that benefited US Treasuries and other safe assets. Despite this, the Federal Reserve continued to tighten monetary policy, albeit temporarily more cautiously. The delay in monetary policy effects, the US government's expansionary budget, and consumer excess savings kept the economy more resilient than anticipated, enabling it to withstand the shock of heightened interest rates somewhat longer.

However, the US fiscal balance became the focus of markets during the summer after Fitch downgraded the sovereign. One thing that remains uncertain for markets is the pace of fiscal expansion. But we believe that, no matter the outcome of the US elections, this policy of increasing government spending will continue. Whether it will be a Democratic or Republican win, it will not matter and issuance on financial markets will remain high.

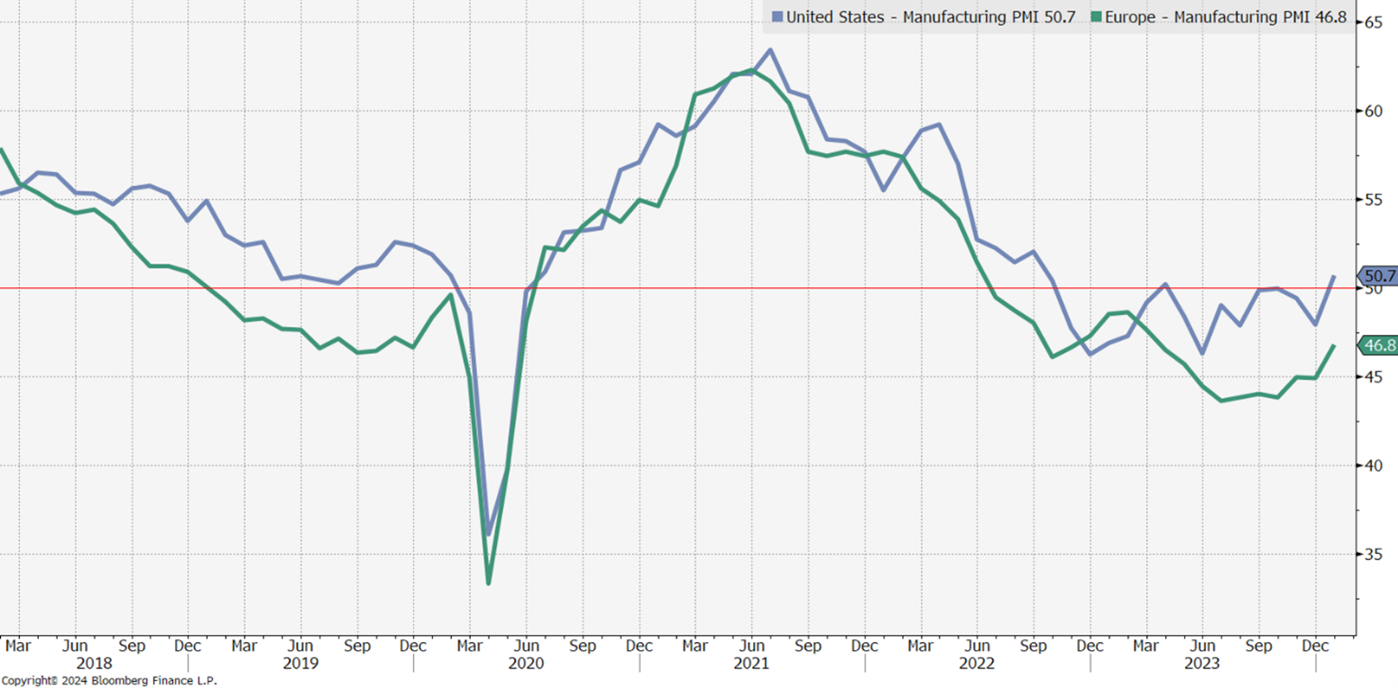

Regarding the US economy, like Europe, we examine the Purchasing Managers' Index (PMI), a leading indicator that pre-empts economic trends before they manifest in GDP reports or employment data. This indicator sheds light on the health of the manufacturing and service sectors. The graph below shows how in 2023, the US manufacturing PMI exceeded the 50 mark only in April. It subsequently declined to 48 the following month, indicating persistent weakness. Overall, manufacturing PMI remains volatile, but the direction is clear. With elevated interest rates, it will be challenging for a sector that is more reliant on financing rates to improve in the short term, even with anticipated interest rate cuts by the Fed. Contrary to this, the robust performance of the service sector was spectacular. It began the year in contraction but remained above the 54 mark until the second quarter, indicating strong expansion. The latest figures, however, also started indicating a deceleration in services activity. As a primary driver of the US economy, this slowdown signals an imminent weakening of the US economy, with monetary policy delays beginning to impact consumers and businesses.

Manufacturing PMIs in Europe and the US are barely above persistent contraction

Source: Bloomberg, PMI by S&P Global, February 2024

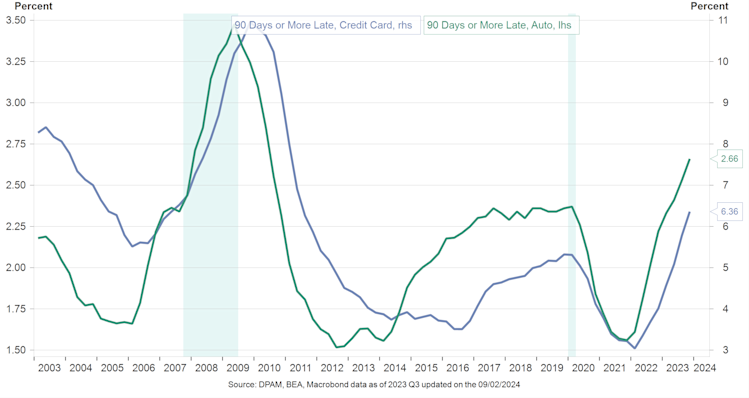

Throughout the year, US GDP continued coming in strong. In the third quarter, it grew by almost 5% while the Eurozone contracted by -0.1%. In the last quarter, the US continued to surprise above 3%, while Europe stagnated. However, we believe those elements that supported high growth last year will contribute much less in 2024 as the economy is turning and inflation is decreasing. Regarding US government expenditures, we anticipate it to remain high, yet its impact on US GDP will diminish as a larger portion is allocated to pay the interest rate debt burden. The latest Beige Book underscored a general slowdown in economic activity, with a less optimistic outlook for 2024. A notable easing in labour demand was observed, with reports of some layoffs and attrition. Wage growth was generally modest, with indications of easing wage pressures. Further, we also continue to monitor delinquency rates. Unlike the Global Financial Crisis (GFC), mortgage delinquencies remain relatively low. However, the steep drop in new house purchases and mortgage applications indicate a strong transmission of higher policy rates. Our focus has shifted to delinquencies in other consumer credit categories, specifically credit cards and auto loans, as plotted in the graph below. The increase in delinquencies in those categories is one of the highest since the GFC. With current high interest rates, we do not foresee an improvement any time soon. In fact, we expect the negative momentum to persist. This reinforces our view that a slowdown in the US economy will impact the job market in 2024.

US deposits & loans, consumer credit by delinquency

Source: Macrobond, U.S. Bureau of Economic Analysis, February 2024

In the final Federal Reserve meeting of 2023, the Fed left its policy rate unchanged. Chair Powell said that further tightening is likely over as inflation is falling faster than expected, and that accordingly, a discussion of rate cuts now comes "into view". This is a clear shift in rhetoric from 'rates higher for longer' to a dialogue on rate cuts. During this meeting, the Fed clearly signalled their recognition of the restrictive nature of the current policy rates. In the case of a soft landing, the Fed's next move will be a quick return to a policy rate that is more in line with the neutral rate. However, in the case of a harder landing, the Fed will cut much more than markets are currently pricing.

In conclusion, it is clear that developed markets are moving to the next phase in the economic cycle. Although it is not yet clear whether we will go through a soft or a hard landing, it will lead to a repricing of interest rates. Even the return to the neutral interest rate, which in the US is currently estimated around 3%, implies market interest rates significantly below current levels. If the probability of a hard landing increases, the interest rate move will be quicker and stronger.

Until central banks confirm the next phase in the monetary policy cycle, we will continue observing volatility in financial markets. This is because better- or worse-than-expected data points will quickly move investor sentiment to the opposing direction and abruptly shift markets. However, this should continue providing good entry points to position for the expected direction of interest rates.

Disclaimer

Degroof Petercam Asset Management SA/NV (DPAM) l rue Guimard 18, 1040 Brussels, Belgium l RPM/RPR Brussels l TVA BE 0886 223 276 l

Marketing Communication. Investing incurs risks.

The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other DPAM communications, strategies or funds.

The provided information herein must be considered as having a general nature and does not, under any circumstances, intend to be tailored to your personal situation. Its content does not represent investment advice, nor does it constitute an offer, solicitation, recommendation or invitation to buy, sell, subscribe to or execute any other transaction with financial instruments. Neither does this document constitute independent or objective investment research or financial analysis or other form of general recommendation on transaction in financial instruments as referred to under Article 2, 2°, 5 of the law of 25 October 2016 relating to the access to the provision of investment services and the status and supervision of portfolio management companies and investment advisors. The information herein should thus not be considered as independent or objective investment research.

Past performances do not guarantee future results. All opinions and financial estimates are a reflection of the situation at issuance and are subject to amendments without notice. Changed market circumstance may render the opinions and statements incorrect.