Glossary

Glossary

Please find below a glossary of terms used in SFDR disclosures.

Article 8 and Article 9 Investment Funds:

The EU’s Sustainable Finance Disclosure Regulation introduced the concept of Article 8 and 9. Article 8 products are financial products that either promote environmental and/or social characteristics or combine the promotion of environmental and/or social characteristics and sustainable investment objectives, provided that the companies in which the investments are made follow good governance practices. Article 9 products are financial products that have sustainable investment as their objective.

CAPEX

Capital Expenditures are funds used to acquire, upgrade or maintain capital assets.

Greenhouse Gas Intensity of a portfolio

The greenhouse gas (GHG) intensity of a portfolio is the weighted average of the GHG intensity (in tCO2e/$M revenue or tCO2e/EURM revenue) of all investees and measures the portfolio’s exposure to carbon intensive issuers

The calculation method for the numerator is based on the acknowledged methodology of the Global Greenhouse Protocol and takes into account the scope 1 emissions (direct emissions resulting from sources which are the property of or are controlled by the reporting issuer), scope 2 emissions (direct emissions relating to the energy use (electricity, heat, steam) required to be able to produce the product on offer) and scope 3 upstream and downstream emissions (for example, indirect greenhouse gas emissions associated with the value chain, respectively purchased or acquired goods and services and the use of sold goods and services). The methodology for calculating the weighted average carbon intensity is aligned with SFDR regulation:

Carbon Footprint of a portfolio

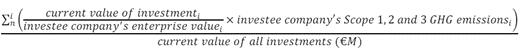

The carbon footprint of a portfolio is also an intensity metric and considers the financed share of emissions of the investees as an attribution factor, in respect to the total portfolio value. In other words, it follows the logic in which the portfolio’s share of a company’s emissions is proportionate to its ownership stake in the business (expressed as an outstanding amount per enterprise value) and is normalised by the total portfolio value. The methodology for calculating the weighted average carbon footprint of a portfolio is aligned with the SFDR regulation:

Compliance with the Global Standards

This normative filter requires that invested companies comply with the following four reference texts on responsible business practice. These four ‘Global Standards’ are: (1) the United Nations Global Compact principles; (2) the Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises; (3) the United Nations Guiding Principles on Business and Human Rights (UNGP); and (4) the ILO Declaration on Fundamental Principles and Rights at Work. These four complementary Global Standards include principles relating to Human Rights, Labour Rights, the Environment, and Governance/Anti-Corruption. This Global Standard filter (also known as a normative screening) aims to ensure that investment strategies do not finance companies whose practices or behaviour violate the underlying principles of sustainable investment. In doing so, this filter plays a role in safeguarding the Do No Significant Harm principle, as defined by the SFDR regulation. Dedicated research by non-financial rating agencies is used to determine whether a company is compliant, watch-listed or in breach of these standards. Non-compliant companies are excluded from the investment portfolios of the relevant strategies. In the case of watch-listed companies, the investment manager reserves the right to carry out its own analysis and possibly exclude the company in question from the relevant strategies.

Climate-related opportunities

Opportunities related to the energy transition and society’s measures to mitigate the causes of climate change and adapt to the consequences of climate change. Four main categories of climate-related opportunities can be identified: resource efficiency, energy source, products and services, markets and resilience.

Source: TCFD.

Climate-related physical risks

Risks which arise as a consequence of climate change (due to the emission of greenhouse gases in the atmosphere). The risks represent the potential negative impacts of climate change on an organisation. Physical risks emanating from climate change can be event-driven (acute) such as increased severity of extreme weather events (for example, cyclones, droughts, floods, and fires). They can also relate to longer-term, chronic shifts in precipitation and temperature and increased variability in weather patterns (for example, sea levels rising).

Source: TCFD.

Climate-related transition risks

Risks which arise due to society’s measures to mitigate the causes of climate change (greenhouse gas emissions in the atmosphere) and adapt to the consequences of climate change. Four main categories of climate-related transition risk can be identified: policy and legal actions, technology changes, market responses and reputational considerations.

Source: TCFD.

DNSH

Do Not Significantly Harm principle. This entails assessing whether an investment in an economic activity that contributes substantially to an environmental or social objective does not significantly harm any environmental or social objectives.

Environmental Objective

DPAM defines this using the framework of UN SDGs. Several SDGs can be grouped together as being explicitly linked to the Environment, SDGs 6,7,9,11,12,13,14,15. The issuer must make a net positive contribution to these environmental objectives, on average, to be considered as an instrument with an environmental objective.

ESG Factors

These are environmental, social or governance characteristics that may have a positive or negative impact on the financial performance or solvency of an entity, sovereign or individual.

ESG impact

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. In the listed space, DPAM social and environmental impact can be measured through companies’ exposure to Impact Themes such as clean energy, access to quality education and access to quality healthcare etc. This exposure can be measured in terms of sales, capex, or other relevant KPIs. DPAM refers to the Iris+ framework by the Global Impact Investing Network (GIIN) both for analysing the impact of companies and for its impact reporting. DPAM only classifies a company as an impact company if the products and services it offers make a significant positive contribution to the framework’s impact themes, while complying with the DNSH principles. The United Nations Sustainable Development Goals are also used as a reporting framework, as is common practice.

ESG risk score of a portfolio

The ESG risk score of the portfolio is the weighted average ESG risk score of the companies in the portfolio. It is calculated by taking into account all the positions in the portfolio that are covered by ESG research from Sustainalytics and their respective weights.

The ESG risk score reflects the remaining material ESG risk that has not been managed by the company in an absolute manner (unmanaged risk). It includes two types of risk: (1) Management gap risks: risks that could be managed by the company through suitable initiatives but which are not yet managed by the company; (2) Unmanageable risks: risks that are inherent to a company’s activities which cannot be addressed by suitable initiatives.

The ESG risk scores can be classified in 5 categories: negligible risk (0-10); low risk (10-20); medium risk (20-30); high risk (30-40); and severe risk (above 40).

Net positive contribution

Regarding contribution to the Sustainable Development Goals, the assessment will look at positive and the negative contributions. The net positive contribution is the difference between the negative and the positive contribution, assuming that this has to be at least positive.

PAI

The principal adverse impacts are defined as negative, material or potentially material effects on sustainability factors that result from, worsen, or are directly related to investment choices or advice from DPAM.

Science Based Target (SBT)

Science-based targets provide a clearly defined pathway for companies to reduce greenhouse gas (GHG) emissions, helping prevent the worst impacts of climate change and future-proof business growth. Targets are considered ‘science-based’ if they are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to 1.5°C above pre-industrial levels. Validation is provided by the Science Based Targets initiative (SBTi), a corporate climate action organisation that enables companies and financial institutions worldwide to play their part in combating the climate crisis.

Source: SBTi.

Science Based Target (SBT) Portfolio Coverage Approach

An approach allowing financial institutions to set engagement targets (to have a portion of their investees set their own SBTi-approved science-based targets) so that the financial institution is on a linear path to 100 percent portfolio coverage by 2040.

Source: SBTi.

Temperature Rating Approach

Financial institutions can use this approach to determine the current temperature rating of their portfolios and take action to align their portfolios to ambitious long-term temperature goals by engaging with portfolio companies to set ambitious targets.

DPAM Net Zero Approach

A forward-looking target setting approach, relying on a combination of the SBT portfolio coverage approach and the Temperature Rating approach (investees set a science-based GHG reduction target or align their scope 1 and 2 emissions with a 1.5°C scenario).

Severity of controversy exposure

A controversy is defined as an incident or scandal to which a company is exposed. These may pertain to environmental, social or governance issues. The impact and risks of these controversies are assessed based on various criteria, such as the gravity, responsibility and exceptional character of the impact, as well as the reputational and image risk. The assessment results in a categorisation that groups a company into 5 different controversy categories, according to the gravity, on a scale from 1 (not very serious) to 5 (extremely serious). The gravity is assessed by ESG rating agencies, based on impact and frequency, the transparency of the information provided by the company and its preventive and corrective measures.

SDGs

The Sustainable Development Goals are the 17 goals defined by the United Nations, which are central to the 2030 Agenda for Sustainable Development. They recognise that ending poverty and other deprivations must go hand-in-hand with strategies that improve health and education, reduce inequality and spur economic growth – all while tackling climate change and working to preserve our oceans and forests.

SFDR Regulation

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector.

Social objective

As defined by the framework of the UN SDGs. Several SDGs can be grouped together as explicitly linked to social factors, SDGs 1,2,3,4,5,8,10,16,17. The issuer must have a net positive contribution to these social objectives, on average, to be considered as an instrument with a social objective.

Sustainability risks

Environmental, social or governance events or conditions that, if they occur, could cause a negative material impact to the value of the investment.

Taxonomy aligned instrument

Taxonomy alignment is calculated based on the technical screening criteria defined by the EU Taxonomy for the eligible activities of the issuer. To be considered as an instrument aligned with the Taxonomy, alignment must be above 10%.

Use of proceeds instrument aligned with reference standards

A use of proceeds instrument is recognised as such if it is fully aligned with the International Capital Markets Association principles and the DPAM monitoring methodology.