A focus on listed real estate

To many of us, owning a house is a major milestone, something to take pride in. However, this accomplishment often comes with its share of drawbacks and costs, including repairs, property taxes and a lack of liquidity.

Real estate stocks can be a way around many of these limitations, offering benefits ranging from diversification, inflation protection to dividend payouts—a great way to enjoy the perks of property investment without the usual management headaches.

Marketing Communication

DPAM B Real Estate Europe Sustainable

DPAM B Real Estate Europe Dividend Sustainable

DPAM B Real Estate EMU Sustainable

Our groundwork for growth

While listed real estate presents a unique combination of liquidity, transparency, and resilience, it also requires careful analysis, knowledge, and active management to optimise returns.

Webinar European Listed Real Estate - Q4 2025

After a period of adjustment, growth and NAV recovery have returned to the European listed real estate market.

Related articles

6 advantages of listed real estate

Our experts break down six pivotal advantages that make listed real estate a great component of a balanced investment portfolio.

Is listed real estate ‘rebound-ready’?

Let’s look at 9 reasons why we believe it is time to prepare for a comeback in European listed real estate.

DPAM’s take on listed real estate

Our listed real estate offering features several different strategies. Find out what makes each one unique and how they could fit into your portfolio.

6 drivers behind Europe’s listed real estate revival

After several years of volatility, the European listed real estate market appears to have reached a turning point in 2025. Fundamental indicators have stabilised, financing costs have decreased, and valuations remain ...

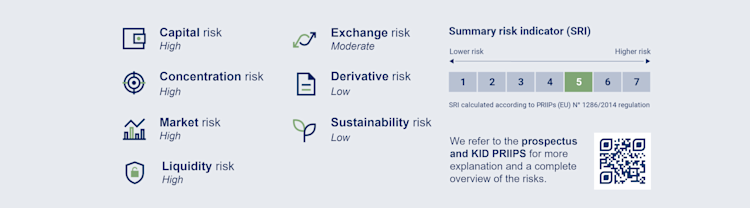

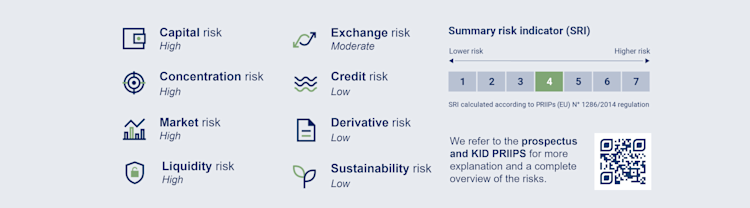

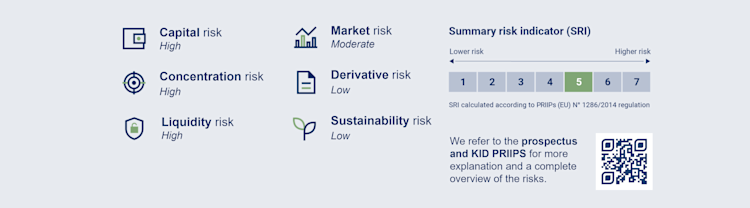

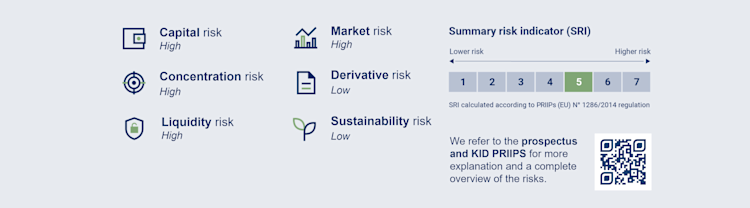

Risks

We closely monitor portfolios to further contain the risks that could impact the value of your investment. Even so, investing in equities and fixed income come with inherent risks. As there is no capital protection or guarantee, you can lose part or all of your capital. The risks that can have a high to moderate impact on the investments are listed below.

ESG challenges contain both risks and opportunities. Through thorough analysis, our experts weigh the benefits against the risks to make informed investment decisions.

DPAM B Real Estate Europe Sustainable

DPAM B Real Estate Europe Dividend Sustainable

DPAM B Real Estate EMU Sustainable

DPAM B Real Estate EMU Dividend Sustainable

Disclaimer

Degroof Petercam Asset Management SA/NV (DPAM) l rue Guimard 18, 1040 Brussels, Belgium l RPM/RPR Brussels l TVA BE 0886 223 276 l

For professional investors only.

This is marketing communication. Please refer to the prospectus and the KID of the fund before making any final investment decisions. These documents can be obtained free of charge at DPAM or on the website https://funds.dpaminvestments.com. Investors can find a summary of their investor rights (in English) on https://www.dpaminvestments.com/professional-end-investor/be/en/regulatory-disclosures.

The management company may decide to terminate the arrangements made for the marketing of this collective investment undertaking in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU.

Past performance does not predict future returns.

The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus or in the information which is to be disclosed to investors in accordance with Article 23 of Directive 2011/61/EU, Article 13 of Regulation (EU) No 345/2013, Article 14 of Regulation (EU) No 346/2013 where applicable.

All rights remain with DPAM, who is the author of the present document. Unauthorized storage, use or distribution is prohibited. Although this document and its content were prepared with due care and are based on sources and/or third party data providers which DPAM deems reliable, they are provided without any warranty of any kind and without guarantee of correctness, completeness, reliability, timeliness, availability, merchantability, or fitness for a particular purpose. All opinions and estimates are a reflection of the situation at issuance and may change without notice. Changed market circumstance may invalidate statements in this document.

The provided information herein must be considered as having a general nature and does not, under any circumstances, intend to be tailored to your personal situation. Its content does not represent investment advice, nor does it constitute an offer, solicitation, recommendation or invitation to buy, sell, subscribe to or execute any other transaction with financial instruments.

This document is not aimed to investors from a jurisdiction where such an offer, solicitation, recommendation or invitation would be illegal. Neither does this document constitute independent or objective investment research or financial analysis or other form of general recommendation on transaction in financial instruments as referred to under Article 2, 2°, 5 of the law of 25 October 2016 relating to the access to the provision of investment services and the status and supervision of portfolio management companies and investment advisors.