Equity

What does the software sell-off really tell us?

Back to all

Equity markets experienced a sharp drawdown, with software stocks at the epicentre. Results from ServiceNow, SAP and Microsoft were fundamentally solid, but growth rates came in marginally below expectations (around 1%). More importantly, however, they showed no near-term acceleration. In the current market environment, this lack of acceleration proved sufficient to trigger a software-wide sell-off, with large-cap names falling more than 10% and correlations across the sector spiking sharply.

While this sell-off undeniably had a large impact on the markets, we believe the severity of the move says more about how markets function today than about a sudden deterioration in software fundamentals.

A changed market structure amplifies downside moves

Market structure has evolved materially in recent years. Today, roughly two-thirds of trading volumes are driven by index funds, hedge funds and retail investors. While very different in mandate, these participants tend to be more momentum-driven. When price action turns negative, positioning is often reduced mechanically rather than reassessed fundamentally.

The consequence is a shortage of natural contrarians. When expectations reset lower, fewer investors are willing (or able) to step in early. This leads to fast, deep and highly correlated sell-offs, even across business models with quite different fundamentals.

The indiscriminate nature of yesterday’s move, which lumped application software, infrastructure software, vertical software and cybersecurity together, strongly suggests that this was flow- and correlation-driven, not a fundamental reassessment of individual companies.

We have seen this pattern before

This event fits a pattern we have observed multiple times over the past year(s) and tends to happen more often:

The semiconductor sell-off following the DeepSeek moment

Alphabet’s share price pressure in early 2025, before subsequently doubling

Meta’s collapse in 2022 amid IDFA-related fears

Importantly, in each case, there was a legitimate fundamental concern. But markets extrapolated the prevailing trend far into the future, effectively pricing in a permanent impairment. With hindsight, those extrapolations proved overly pessimistic.

Today’s concern is that AI represents an existential threat to enterprise software. We think this framing is overly simplistic. Even so, this risk is not easily dismissed. That uncertainty, something markets absolutely do not like, has been quickly discounted this year through lower terminal multiples, with severe drawdowns (i.e. 40–50% versus 52-week highs) as a result.

Slowing growth is being confused with obsolescence

Software growth is undeniably maturing. But markets are conflating maturation with structural issues.

Generative AI has made impressive progress, particularly in software development. Public examples of AI agents writing large portions of code and so-called “vibe coding” are real and compelling. However, this does not imply that enterprise software will be rewritten entirely or displaced en masse.

Crucially, selectivity matters. Simple, single-product application software, especially tools that sit on the edge of workflows, will be easier to copy or replace over time. These products tend to compete on functionality, rather than on how deeply they are embedded in day-to-day operations.

By contrast, mission-critical systems of record occupy a very different position. These platforms contain a company’s most important operational, financial and regulatory data and are deeply integrated across processes and departments. Reliability, security, compliance, uptime and long-term support are at least as important as functionality. Switching costs are high, and replacement risk is structurally low.

Companies such as ServiceNow, Intuit, SAP and Roper exemplify this category. Their value proposition extends well beyond software features: it is about owning the core business context, orchestrating workflows and being deeply embedded in daily operations. In many cases, AI enhances rather than undermines the strategic value of these platforms, as intelligence is applied directly where the data already resides.

SAP reported 25% cloud bookings growth and 11% total revenue growth, while continuing to guide for further acceleration. ServiceNow grew revenues by nearly 20% and expects a similar pace next year.

More broadly, cloud software growth is maturing. While only roughly 40% of workloads are estimated to be in the cloud, penetration is already higher for some segments (e.g. CRM, HCM), whereas others (e.g. ERP, databases), where we are invested, remain largely on-premise, implying a longer runway. This slows growth, but it is not due to AI disruption. For most companies, AI revenue contributions remain too small to re-accelerate growth.

Microsoft results commentary

Microsoft’s results were strong. Revenue growth was 15%, with earnings up more than 20%, while Azure is still expanding at a 38% rate, although that was slightly below expectations.

Microsoft noted that it could have delivered around 40% Azure growth, something that, in our view, would more likely have supported the share price, as demand continues to outstrip supply. Instead, the company is prioritising GPU allocation towards its own applications (notably Copilot) and internal R&D, including the development of proprietary AI models. Investors looked for a cleaner Azure upside surprise and remain cautious on Copilot, particularly given the uncertainty around its gross margin profile.

Management views Copilot as strategically important to protect Microsoft’s long-term positioning. Microsoft also disclosed that M365 Copilot paid seats have reached 15 million. JPMorgan estimates this equates to roughly 3–6% penetration of the eligible installed base. A Morgan Stanley survey further supports the longer-term adoption path, with 80% of CIOs indicating they expect to use M365 Copilot within the next 12 months.

Investor concerns also extend to Microsoft’s exposure to OpenAI, following the announcement of a USD 250 billion deal and the disclosure that OpenAI represents 45% of remaining performance obligations (RPO). That said, RPO excluding OpenAI grew a solid 28%, pointing to broad-based underlying demand. It may take several quarters before OpenAI’s next major release (ChatGPT-6) provides a clearer data point for how the competitive landscape amongst AI labs is evolving.

Finally, some investors question Microsoft’s decision to build its own AI models, and its right to win in that domain. With Microsoft trading at around 21x FY27 P/E and offering a high-teens EPS growth profile, we believe investors are being paid to wait.

Two underappreciated realities about AI adoption

First, even leading AI labs continue to rely on traditional enterprise software platforms, such as Salesforce or Workday, for core internal operations. If AI-native organisations are not replacing these systems with GenAI-driven alternatives, it underscores how difficult it is to replicate systems of record.

Second, enterprise software is embedded in systems and in people. Employees have accumulated years of experience working within specific platforms. Replacing software therefore also means retraining organisations and temporarily losing efficiency, often at a cost far greater than the software licence itself.

Where AI could have a more tangible impact is on IT budgets. While budgets continue to grow, they are not unlimited, and AI initiatives need to be funded from within those same allocations. Incremental spending on AI could therefore put further pressure on longer-term growth rates. As we’ll discuss in more detail below, current valuations already reflect lower growth assumptions, which we believe are overly pessimistic.

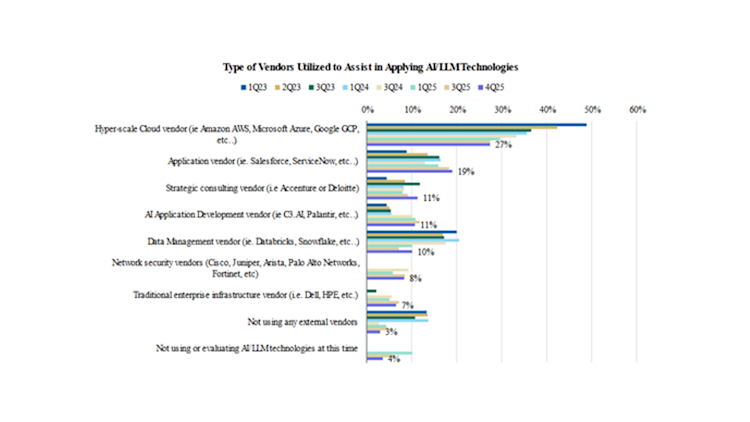

Bernstein conducted a broad survey among large enterprise CIOs, indicating an increasing preference to implement AI through current SaaS vendors.

CIOs prefer application vendors to apply AI

Source: AlphaWise, Morgan Stanley Research. This question allows multiple responses. 168 responses

The zero-sum misconception around AI

The idea that AI will “destroy software” also rests on an implicit zero-sum assumption.

The global enterprise infrastructure software market is estimated at roughly USD 600 billion (Gartner). Redburn calculated that in the United States, 38 million people work in roles where a meaningful proportion of tasks could be automated, representing almost USD 2.8 trillion in labour costs. If AI is meaningfully disruptive, it is far more likely to pressure services and labour-intensive activities rather than the software layer itself, which represents less than 1% of global GDP.

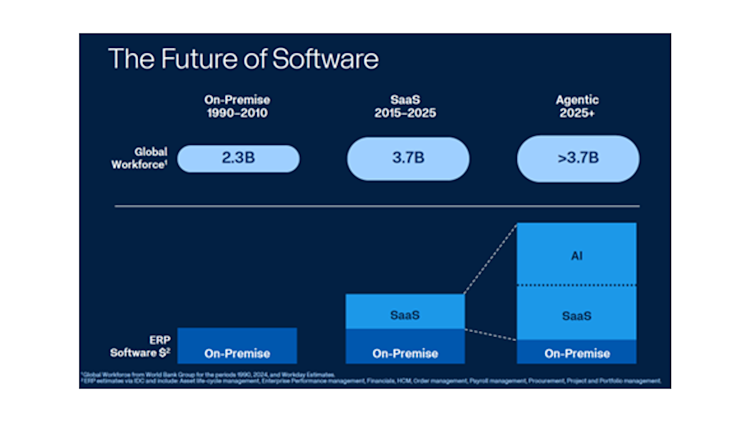

In practice, we expect AI to be layered on top of existing software, enhancing how people work rather than replacing the platforms where enterprise data already resides.

AI will tap into the services market rather than SaaS market

Source: Workday Analyst Day 2025

Adoption will be gradual, not binary

Generative AI is probabilistic by nature. Integrating it reliably into mission-critical enterprise workflows will take time. In enterprise workflows, there is no room for hallucinations.

Moreover, many companies still need to take the first step, migrating to the cloud, integrating systems and cleaning data so it can be used effectively in AI-driven processes. These steps are prerequisites for meaningful AI adoption. We believe infrastructure software names (i.e. Snowflake, Datadog) will benefit in these areas.

The jury is still out on whether AI labs or incumbent software vendors will be the first to build scalable enterprise workflows. What is clear is that this transition will be evolutionary rather than instantaneous. For the foreseeable future, enterprises are likely to adopt a “human-in-the-loop” model, where AI agents support and accelerate workflows, but humans remain responsible for validation, oversight and final decisions. Because this interaction happens where employees already work, AI is most likely to be embedded within existing software environments, rather than deployed as standalone replacements.

How do we see this evolving?

Timing a bottom is inherently difficult. Markets can remain irrational for longer than fundamentals would justify.

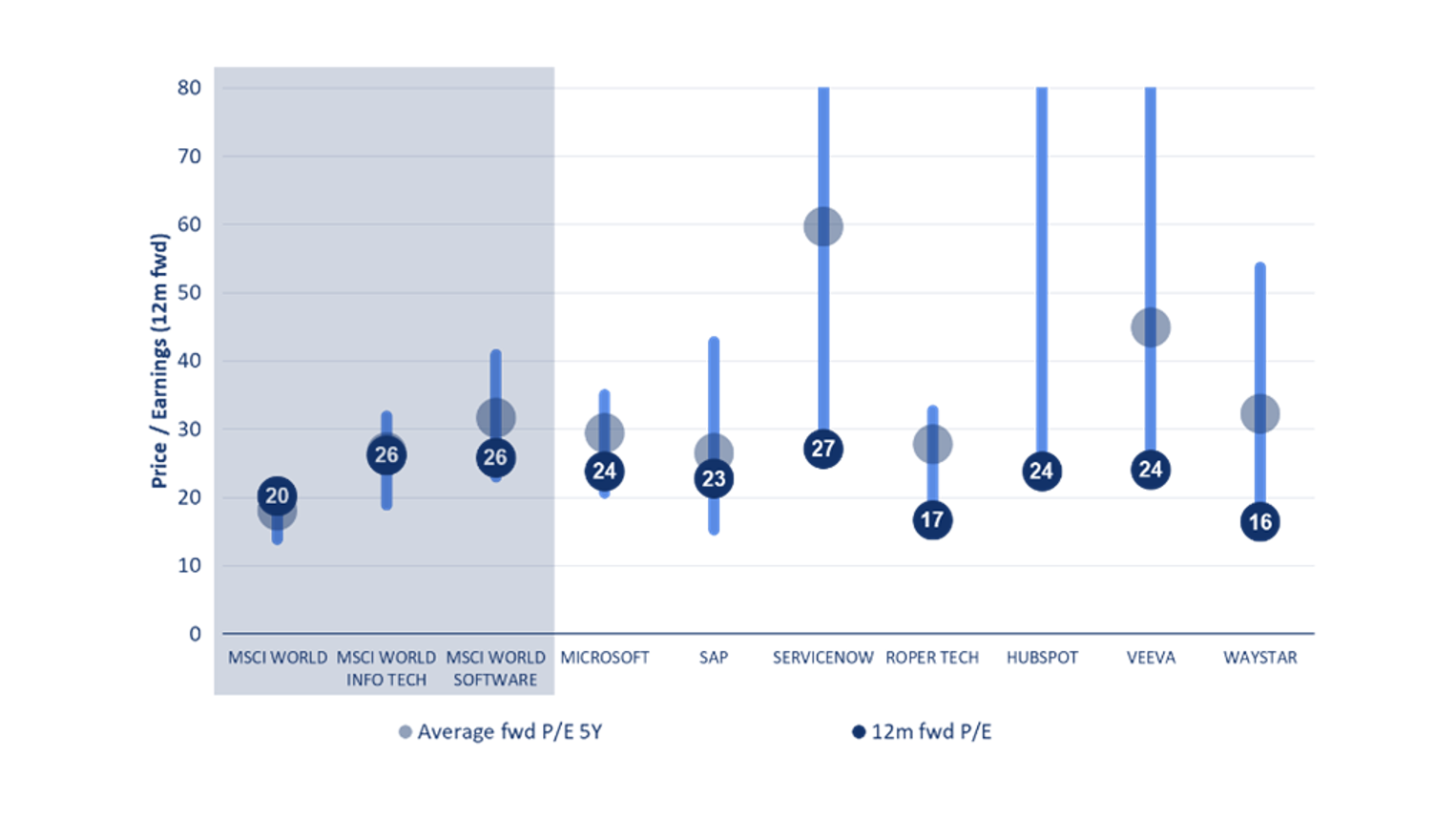

That said, valuations have reset sharply. Many software companies have halved in market value, while revenues and earnings have continued to grow at healthy rates. Several names trade at or below market multiples, with some valuations implicitly assuming limited future growth.

We believe the fair value of many of these companies is materially above current prices. Selling at these levels would largely reflect a concern that conditions may deteriorate further in the near term, rather than a loss of conviction in the long-term fundamentals.

12m fwd P/E vs 5-year range

Source: Bloomberg, MSCI, 29.01.2026

What could unlock value?

Several potential catalysts stand out:

Margin expansion: software companies are themselves beneficiaries of AI-driven productivity gains, particularly in software development. This should support margins, offsetting initially lower gross margins on AI-related revenues.

Greater AI revenue visibility: as customers complete cloud migrations, integrate data and adapt workflows, AI-related revenues should become more tangible. We expect this to translate into clearer monetisation and a more predictable contribution over the course of next year.

Capital return optionality: most large software companies have strong balance sheets and robust free cash flow generation. At current valuation levels, this creates scope for accelerated share buybacks, providing downside support and enhancing per-share value over time.

Stabilisation of flows: once volatility subsides and correlations normalise, we expect investors to re-engage as price action stabilises and fundamentals reassert themselves.

Bottom line

The recent sell-off reflects a shift in market dynamics and heightened uncertainty around AI, rather than a fundamentally broken thesis. While growth is maturing and near-term volatility may persist, the market has moved quickly to discount long-term risks that are, in our view, being overstated.

High-quality software companies, particularly mission-critical systems of record, remain deeply embedded in enterprise operations, benefit from durable switching costs and continue to generate strong cash flows. At current valuation levels, prices imply a degree of structural impairment that we do not see supported by fundamentals.

Over time, as uncertainty around AI adoption clears and fundamentals reassert themselves, we believe this gap between price and intrinsic value should narrow.

Disclaimer

Degroof Petercam Asset Management SA/NV (DPAM) l rue Guimard 18, 1040 Brussels, Belgium l RPM/RPR Brussels l TVA BE 0886 223 276 l

Marketing Communication. Investing incurs risks.

The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other DPAM communications, strategies or funds.

The provided information herein must be considered as having a general nature and does not, under any circumstances, intend to be tailored to your personal situation. Its content does not represent investment advice, nor does it constitute an offer, solicitation, recommendation or invitation to buy, sell, subscribe to or execute any other transaction with financial instruments. Neither does this document constitute independent or objective investment research or financial analysis or other form of general recommendation on transaction in financial instruments as referred to under Article 2, 2°, 5 of the law of 25 October 2016 relating to the access to the provision of investment services and the status and supervision of portfolio management companies and investment advisors. The information herein should thus not be considered as independent or objective investment research.

Past performances do not guarantee future results. All opinions and financial estimates are a reflection of the situation at issuance and are subject to amendments without notice. Changed market circumstance may render the opinions and statements incorrect.