A focus on quality-growth

Aim High. Reach Higher.

DPAM B Equities World Sustainable

Marketing Communication

Consistent growth. Strong profitability. A clear long-term vision.

In the vast investment landscape, quality factors have always been synonymous with reliability and stability. By focusing on a quality approach, investors not only prioritise long-term growth, but also position themselves to go on the offensive when everyone else is on the defensive.

Thanks to our in-house research team, our proprietary ESG approach and our deep understanding of the markets, our DPAM B Equities World Sustainable fund is ideally oriented to help you combine the best of a resilient quality-growth equity strategy with a global perspective and a sustainable edge.

Aim for enduring performance, but with purpose.

Do you want to know more about DPAM B Equities World Sustainable?

World Sustainable: From strategy to success

Find out how the team behind our World Sustainable fund brings together global ‘Proven Winners’ to create an impressive quality-growth equity offering with a clear focus on sustainability.

About DPAM B Equities World Sustainable

Pioneering innovation, enduring growth, unmatched quality. Uncover the essence of our 'Global Sustainable' approach.

Meet the Team

Diverse minds. One singular mission. Explore the dynamic synergy behind 'World Sustainable'.

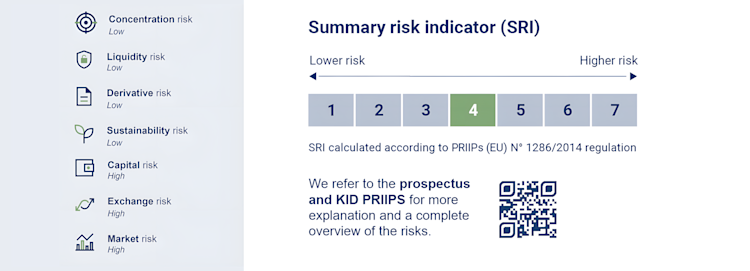

Risks

Disclaimer

Degroof Petercam Asset Management SA/NV (DPAM) l rue Guimard 18, 1040 Brussels, Belgium l RPM/RPR Brussels l TVA BE 0886 223 276 l

For professional investors only.

This is marketing communication. Please refer to the prospectus and the KID of the fund before making any final investment decisions. These documents can be obtained free of charge at DPAM or on the website www.dpamfunds.com. Investors can find a summary of their investor rights (in English) on https://www.dpamfunds.com/sites/degroofpetercam/regulatory-disclosures.html. The management company may decide to terminate the arrangements made for the marketing of this collective investment undertaking in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU.

The objective of the DPAM B Equities World Sustainable sub-fund is to offer investors exposure to equities and/or equity-equivalent securities issued by companies without any geographical restrictions, and to all securities giving entitlement to the capital of these companies, selected on the basis of a strict methodology in terms of respect for environmental, social and governance (ESG) criteria.

More information on the sustainability characteristics of the fund can be found in our quarterly sustainability report or the fund’s prospectus.

The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus or in the information which is to be disclosed to investors in accordance with Article 23 of Directive 2011/61/EU, Article 13 of Regulation (EU) No 345/2013, Article 14 of Regulation (EU) No 346/2013 where applicable.

All rights remain with DPAM, who is the author of the present document. Unauthorized storage, use or distribution is prohibited. Although this document and its content were prepared with due care and are based on sources and/or third party data providers which DPAM deems reliable, they are provided without any warranty of any kind and without guarantee of correctness, completeness, reliability, timeliness, availability, merchantability, or fitness for a particular purpose. All opinions and estimates are a reflection of the situation at issuance and may change without notice. Changed market circumstance may invalidate statements in this document.

The provided information herein must be considered as having a general nature and does not, under any circumstances, intend to be tailored to your personal situation. Its content does not represent investment advice, nor does it constitute an offer, solicitation, recommendation or invitation to buy, sell, subscribe to or execute any other transaction with financial instruments. This document is not aimed to investors from a jurisdiction where such an offer, solicitation, recommendation or invitation would be illegal. Neither does this document constitute independent or objective investment research or financial analysis or other form of general recommendation on transaction in financial instruments as referred to under Article 2, 2°, 5 of the law of 25 October 2016 relating to the access to the provision of investment services and the status and supervision of portfolio management companies and investment advisors.